Has there been wage growth? Is it really fuelling inflation?

With an incoming new government elected on Saturday 21 May, by the people of Australia, we thought it worth revisiting some current economic indicators, as we watch the new parliament form, it will be interesting to see how these issues manifest.

In our last edition we talked about what is pushing inflation is it demand or the cost base (which includes wages). The ABS data released this week on the March quarter Wage Index shows wages grew by 0.7%. This meant a 2.4% over the year to the March quarter, slightly less than market expectations.

A closer look at the ABS data reveals that private sector growth again was greater than the public sector and the growth was pushed by large increases in a few concentrated private sector industries. Namely retail (as operators attempted to attract staff back post COVID-19 restrictions) and mining/construction (particularly residential property). Wages growth (that’s without looking at subcontracting tradies who are receiving an increased fee) is not what is pushing inflation at present.

In fact the demand pull connected with the residential construction industry for materials and labour (skilled trades or otherwise) is further extenuated by supply chain issues (COVID-19 and European conflict issues) and the lack of skilled migration to Australia. Some sectors of the Australian population have been on a spending spree. They haven’t been travelling overseas for that annual trip and spending around say $15,000 to $20,000 per annum now for two years. So it went on items such as holiday homes, caravans, new cars and property investments.

The RBA did its first bit to curb this demand by increasing the official cash rate. How much more does it have to do to reign in the “runaway” inflation. A few more interest rate hikes? And when? To achieve what?

Obviously to curb demand that then slows/reduces inflation so that we have steady growth in a low inflation environment. What happens if there are too many increases or they are too severe. We could get stagflation. So, will we get stagflation?

What is stagflation? Minimal growth coupled with high inflation. Remember 1981-83 when we had high unemployment and high inflation. With the current level of economic growth and the low unemployment rate (~4%), Australia isn’t in that situation at the moment. If high unemployment and high inflation did happen, then households may find it hard to maintain employment and retain their standard of living. And a standard of living is what the goal is for most of us.

What are the drivers of this possible stagflation move? This time stagflation could be driven by very different circumstances; new COVID-19 variants, the continued lockdown in China effects on supply chains and the persistence of the Russia – Ukraine conflict that could escalate commodity costs for oil, wheat, specialty minerals, timber and wheat. The pressures on wheat demand could be good for our farmers this year.

Therefore without a wages growth and the continuance of inflation a risk could develop that households reduce their spending which could precipitate lower growth. The possibility that stagflation effect will become real!

With this attention to wages growth commentary flooding the news over the past few days, Milan and I thought we would join the conversation as we take a look at the growth cycle for houses and units in Western Australia.

Is an apartment a good investment?

What is always important to consider with further predicted interest rate rises is the other financial implications for your investment strategies, as well as the day-to-day impacts of a rise in your weekly mortgage payments. With recent pressures on housing prices and affordability, many people are now wondering if a unit is a good investment for themselves, either to downsize, purchase for their investment portfolio or fund to assist their children (via the bank of Mum and Dad).

Whilst we can’t directly answer that for you or your personal circumstances, we thought it would be helpful to compare housing and unit prices in Perth recently.

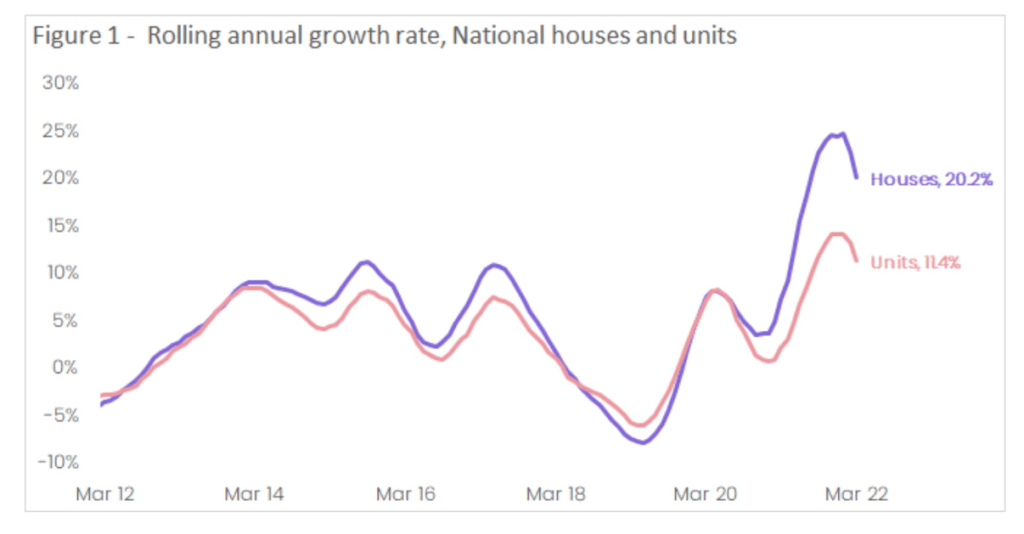

Economic commentary at present shows that nationally both houses and unit prices have peaked and are in a downward swing. Demand for properties nationally is now being referred to as a soft market indicating that property sales are slowing. WA typically has had some different economic cycles and it can be tricky to make headway of the commentary from national sources versus what we see day to day living in our lovely State.

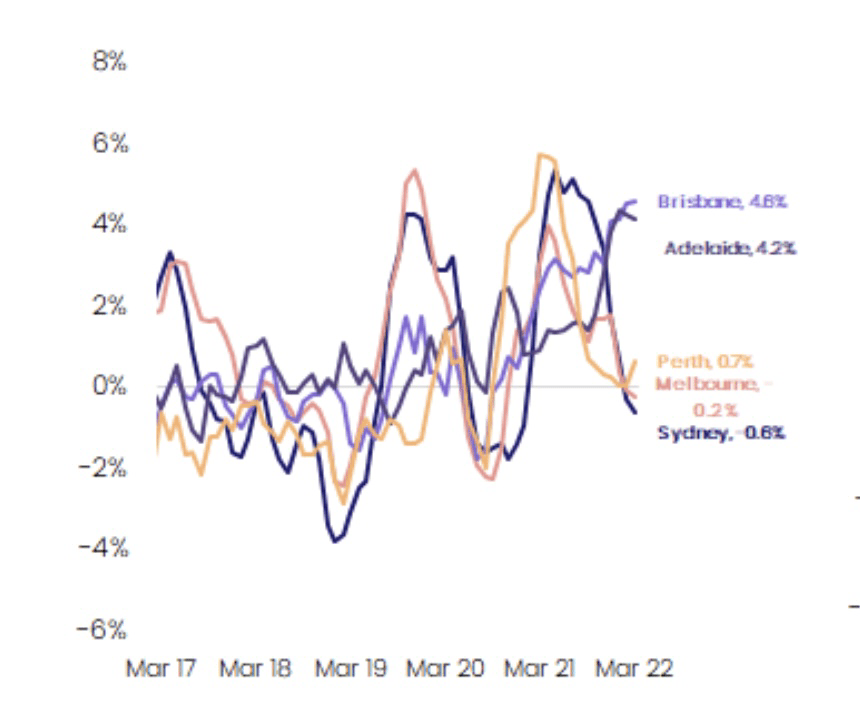

So let’s take a look at some of the Perth market data of late. The softer market conditions nationally have not impacted all markets and the value of homes and units equally. Over the month of March 2022, growth in houses nationally was 0.5% across the combined capital cities, outperforming units (which were steady over the month). Metro Perth overall property performance for the past quarter was in comparison 1.9%.

There was growth in unit prices last quarter in Perth metro and regional markets

Recent data released by Core Logic has shown that in the Perth market, with borders recently reopening, had a strong influx of interstate purchasers which helped to reverse the curve for unit values. Perth has recorded a surprise reversal in its quarterly growth trend, with the reopening of the WA border potentially pushing unit values 0.7% higher over the three months to March. Units in regional WA overall performed well at 4.3% growth for the quarter.

In comparison, there was considerable heat removed from the Sydney unit market, with 51.4% of Sydney’s unit markets analysed in CoreLogic’s Mapping the Market Report recording a decline in values over the first quarter. So if you take a look at Figure 1, that explains the major gap of decline in unit prices on a national basis.

Image Courtesy of Core Logic

Overlaying the national decision recently to lift interest rates, the first time in a decade, plus conservative commentary of property prices, increases in the cost of living, slow rising wages (except retail and mining sectors) as well as the variable of lower home affordability means that we are most likely looking at a subdued unit market growth in Perth in the long term.

However, buying an apartment is not always just about the money. So you will need to weigh up a few points such as the need for an affordable home in a location that you love, whether downsizing helps you achieve lifestyle goals or whether you are ready to put that lawnmower out to pasture. So whether you are seeking capital growth or needing to help your children out with a deposit to buy their own apartment you may wish to seek the advice of a financial planner.

Should my son or daughter use their superannuation to fund their deposit?

There has been a lot of news items this week about first home buyers using their superannuation to fund their first home. It’s even been used by different parties as part of their federal election campaigns. However, this is not a new idea, and currently a first home buyer can fund up to $30,000 of their home deposit via their superannuation fund.

This could be a very good option for some, particularly those young guns who are good savers and want to take advantage of the tax breaks of pre-tax super contributions as well as the returns enjoyed inside a super fund. This could speed up their savings and their deposit gap so they can get into their own home sooner.

Canstar recently looked into the first home super scheme, and you can read more about what’s involved here:

https://www.canstar.com.au/home-loans/first-home-super-saver-scheme/

Any person seeking to undertake an investment strategy or a change in their retirement planning should always consider seeking professional legal or financial advice and seeking the expertise of a qualified tax accountant.

Good luck with the investing strategies.

#moneymanagement #wealth #goodmoneyconversation #savings

A helpful overview

LikeLike

Thanks Roger for taking the time to read our tips 😄

LikeLike